I remember the first time I sat down with a financial advisor and had to answer the big question: “How much should I save each month for retirement?” It felt like a punch to the gut. The truth is, the answer isn’t one-size-fits-all.

But after crunching the numbers, setting goals, and getting real about my future, I discovered some key insights that made it much easier to figure out the right savings plan for me.

I used to think retirement was something that I could think about later—after all, it felt so far off. But here’s the thing: the earlier you start saving, the less you’ll need to set aside each month thanks to the power of compound growth.

You see, small contributions made early on can snowball into big savings over time. Let’s break down how to set yourself up for financial success.

How Much Should I Save Each Month for Retirement?

When people ask, “How much should I save each month for retirement?” The first thing I tell them is that it depends on a few key factors: your age, your income, your desired lifestyle in retirement, and how much you’ve already saved.

There’s no magic number that works for everyone, but there are guidelines that can help you track your progress.

Key Insights to Kickstart Your Savings Journey

1. Start Early and Let Compound Growth Do the Work

The earlier you start saving, the less you’ll need to put aside each month. Compound growth is your friend here. Basically, the money you save today earns interest or investment returns, and that interest earns more interest over time.

It’s like planting seeds and watching it grow into a mighty tree. If you can start in your 20s or 30s, even small amounts will build up significantly over time.

Pro Tip: If you’re in your 20s, saving just $200 a month at a 7% return could grow to $1 million by the time you’re 65. Yes, really!

2. Maximize Your Employer’s 401(k) Match

Employer retirement plans, especially 401(k)s, often come with a company match. This is free money, so don’t leave it on the table. If your employer offers a match, contribute at least enough to take full advantage of it.

That’s essentially a guaranteed return on your investment. If they match up to 5%, make sure you’re putting in at least that amount.

Real-World Example: If your employer matches 100% of your contributions up to 5%, and you contribute 5%, your retirement savings will effectively double!

3. Use Financial Tools to Set a Realistic Goal

Setting a retirement goal can be tricky, but online tools and calculators make it easier. Tools like the NerdWallet Retirement Calculator let you input your current savings, income, and desired retirement age to calculate how much you need to save each month to meet your goals.

These tools can also help you adjust your plan as life changes.

Pro Tip: Consulting with a financial advisor to personalize your savings plan can give you peace of mind knowing you’re on track.

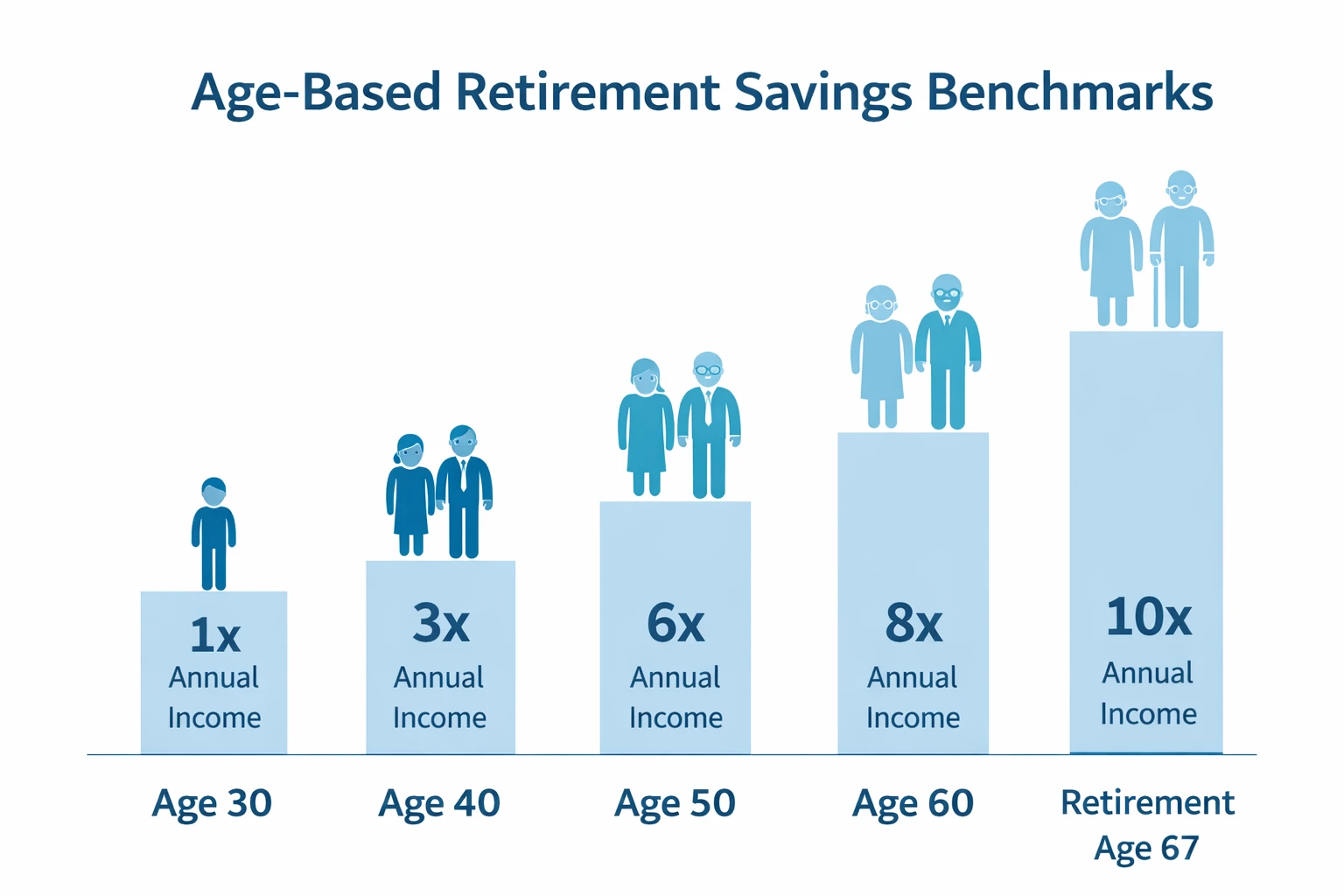

Age-Based Benchmarks for Retirement Savings

So, how much should you aim to have saved by certain ages? Financial planners often use these age-based benchmarks to help guide your savings journey:

- By age 30: Aim to have saved 1x your annual income.

- By age 40: Aim for 3x your annual income.

- By age 50: Aim for 6x your annual income.

- By age 60: Aim for 8x your annual income.

- By retirement (age 67): Aim for 10x your annual income.

Personal Insight: These benchmarks can feel intimidating, but keep in mind that everyone’s journey looks different. The goal is to make steady progress toward these benchmarks, not to stress about perfection.

How Much Will You Need to Replace Your Income?

When planning for retirement, it’s important to think about how much of your current income you’ll need to replace. Most financial planners suggest aiming to replace 70% to 80% of your pre-retirement income to maintain your standard of living.

Tip: If you want to live comfortably in retirement, aim for the higher end of that range—80% or even 85% if you’re planning on traveling or pursuing expensive hobbies.

How to Calculate How Much to Save Each Month for Retirement

Step 1: Assess Your Current Financial Situation

Before you can determine how much you need to save each month, take a look at your current income and expenses. What do you have saved already? What’s your income now? How much are you currently contributing to retirement accounts?

Pro Tip: Make sure to track all of your spending, including small purchases that can add up over time, like subscription services and impulse buys. Cutting back on these can boost your retirement savings.

Step 2: Use a Retirement Calculator

Once you have a clear idea of your current financial situation, plug your numbers into a retirement calculator. These tools will give you a more accurate figure for how much you should be saving each month based on your goals.

Step 3: Adjust Your Contributions as Needed

As you progress through life, your income and expenses will change. Whether it’s a raise, a new job, or paying off debt, it’s important to reassess your savings plan annually and adjust accordingly.

Tip: If you get a raise, try to increase your retirement savings by at least 50% of the extra income. It’s an easy way to boost your savings without sacrificing your lifestyle.

Frequently Asked Questions

1. How much should I save for retirement if I’m 30?

If you’re 30, aim to have saved 1x your annual income by this point. If you haven’t started saving yet, don’t panic! Start by setting aside what you can now and gradually increase your contributions.

2. What’s the best way to save for retirement?

The best way to save for retirement is to contribute regularly to tax-advantaged accounts like a 401(k) or IRA. Don’t forget about employer matching contributions—it’s free money that can make a huge difference in your long-term savings.

3. Should I invest my retirement savings?

Yes, investing is essential for growing your retirement savings. While it can be risky in the short term, over the long term, investments generally outperform savings accounts. Just make sure you’re comfortable with the level of risk in your portfolio.

4. Can I retire early if I save aggressively now?

It’s possible! If you aggressively save and invest in your 20s and 30s, you could reach financial independence and retire early. This is a popular strategy among the FIRE (Financial Independence, Retire Early) movement.

The Bottom Line: Take Action Today for a Brighter Tomorrow

The sooner you start saving, the more you’ll reap the rewards of compound growth. Remember, it’s not about perfection—it’s about making consistent contributions toward your future.

Don’t let the question of “How much should I save each month for retirement?” overwhelm you. Start small, and adjust as you go. You’ve got this!